Beyhan de Jong and Gorjan Nikolik, senior seafood analysts at Rabobank, say reaching this milestone in tonnage in 2030 would be a major turning point for the insect industry.

“The insect industry is on the way to growing in size, supported by investments and partnerships. Efficiency gains from increasing technology, automation, improvements in genetics and changes in legislation can also reduce costs. After reaching half a million tons, it will be easier for the industry to expand the supply. From that point on, it will take much less time to double or even quadruple production volume and exceed one million tons. “

While sustainability aspects and functional benefits support growth in demand, high costs and prices, currently limited production capacity and legislation are the main factors constraining the growth of the sector. This is evident from the new publication: No Longer Creep: Insect Protein Is Growing Up in the 2020s.

Currently, pet food is the largest insect protein market, followed by the Aquafeed market, but as a niche ingredient.

“Today only a few thousand tons of insect proteins are used in Aquafeed. Insect proteins have been shown to be nutritionally beneficial for fish. At the current price level, however, excellent nutritional values alone are not enough to use insect proteins on a large scale. “

Current obstacles to growth If you

Value creation potential

Looking at other avenues for future growth, there is also significant potential for value-added applications for insects. “With ongoing research and development, we anticipate the development of new insect products with specific functions for gut health, palatability, disease resistance and possibly even for non-feed applications such as pharmaceutical products.”

The first challenge facing the industry is the lack of scalability, said these fish specialists.

The world’s quantities of insect protein are currently around 10,000 tons, led by some larger manufacturers and many small companies, according to the analysts.

After producing smaller quantities in test facilities, many of the leading players in the industry are flying – mealworm producers like Ynsect in France or black soldiers [BSF] Farmers like AgriProtein based in the UK, Protix based in the Netherlands and InnovaFeed based in France have built larger facilities to produce on a large scale.

Some of these plants are already running at full capacity or almost at full capacity, others have yet to be opened. Most of these companies plan to build multiple production facilities around the world.

“At least at the moment, the demand for insect protein seems to be higher than the supply. Aquafeed companies state that the lack of available volume is one of the main reasons insect proteins are not used as they deal with large volumes and production runs. Some pet food companies also state that the market could absorb more if availability were higher. “

The analysts indicate that the design of the facility will be a critical success factor in air conditioning and preventing the transmission of pathogens and other contaminants as it moves to scale.

“From breeding to hatching, rearing and processing, a controlled environment under one roof is required to ensure production safety. As in any monoculture farming, insect farming businesses that achieve food and feed safety are best placed to get regulatory support for larger scale production. “

Insect protein is still too expensiveIf you

High costs and thus high prices also limit the demand for insect protein.

The price of insect protein is now between € 3,500 ($ 4,250) and € 5,500 ($ 6,066) per ton, which is significantly higher than that of fishmeal and soy protein. Fishmeal prices historically reflect the volatility of supply – in the past five years they have increased from $ 1,200 to $ 2,000 per ton, the industry release said.

However, the analysts said the sustainability benefits insects can bring to seafood – such as reducing reliance on seafood ingredients – coupled with marketing the end product can justify relatively higher prices.

“If there are well-known functional benefits in addition to the nutritional benefits, their use in Aquafeed would increase.”

A trend reversal could occur in anticipation of legal developments If you

Legislation for raw materials and end markets for insect breeding varies across the world, the analysts reported.

Within the EU, the types of raw materials that can be used to raise insects are limited. Former food waste, which includes fish and meat or catering waste and slaughterhouse products, is not permitted as raw material for insect farms. Legislation could change, however, the Rabobank duo said.

Edible insects

“In our view, insects have greater potential as a feed ingredient than as direct consumer food over the next ten years. Although edible insects meet all the criteria in terms of nutrition, health and sustainability, current consumer acceptance is still low, both for whole countries as well as processed insect-based foods. Their market share is negligible, and options are limited, at least for now. “If you can

“The insect industry expects unprocessed former food waste, which includes meat and fish, as well as undervalued former food (e.g. with unavoidable packaging residues) to be approved as raw materials for insect farms by 2022.

“This would increase circularity by upcycling resources that would otherwise be discarded. This would also bring more flexibility and cost benefits to the insect industry, as the use of catering waste and other waste, which includes meat and fish, could present an opportunity for negative feed costs. “

In the EU, insect protein can only be used as animal feed and as an aquafeed ingredient, but not as pig or poultry feed. On the other hand, insect oils and live larvae are already approved for use in all markets.

“Future approval of insect protein in poultry and pig markets is under discussion, and approval is expected by 2022. While we believe the pig market is a small potential market for insect protein, we believe that poultry feed offers significant opportunities.”

According to the analysts, laying hens have the greatest potential for poultry feed. “The egg market enables differentiated concepts and categories such as free-range, organic, addition of omega-3 fatty acids, etc., which offer space for the marketing of eggs fed with insects.”

Legislation in North America is different, they added.

In the United States, the Food and Drug Administration (FDA) regulates animal feed and food, but there are differences between states in regulating insects as animal feed. Insects should be raised on raw materials approved by American feed control officials. Pre-consumer waste and other by-products are permitted as starting materials. In Canada, insect farm raw materials can be made from food waste if approved by the Canadian Food Inspection Agency.

Insect meal is not yet approved as an animal feed ingredient in the USA, but it is approved as a poultry and salmonid feed ingredient. In Canada, the use of insect meal is permitted as an ingredient in pet food, but not yet as an ingredient in aquafeed and poultry feed.

“Legislative changes are expected in both markets in the course of 2021.”

Substantial investor interest If you

However, insects have received significant investments, especially since 2018, which allow insect companies to set up larger production facilities, the fish specialists find.

“Capital inflows into the sector accelerated after the EU approved the use of insect protein as an aquafeed ingredient in July 2017.

“Insect investments in 2018 were around 45% higher than the sum of the investments received in the last three years. Reported investments in insects currently amount to almost EUR 1 billion. “

The largest disclosed investments were made in Ynsect and InnovaFeed in late 2020.

“The insect companies that have received the largest investments are characterized by their business models, partnerships or the rapid expansion of the geographic and product suite.”

Switch to the mainstream If you

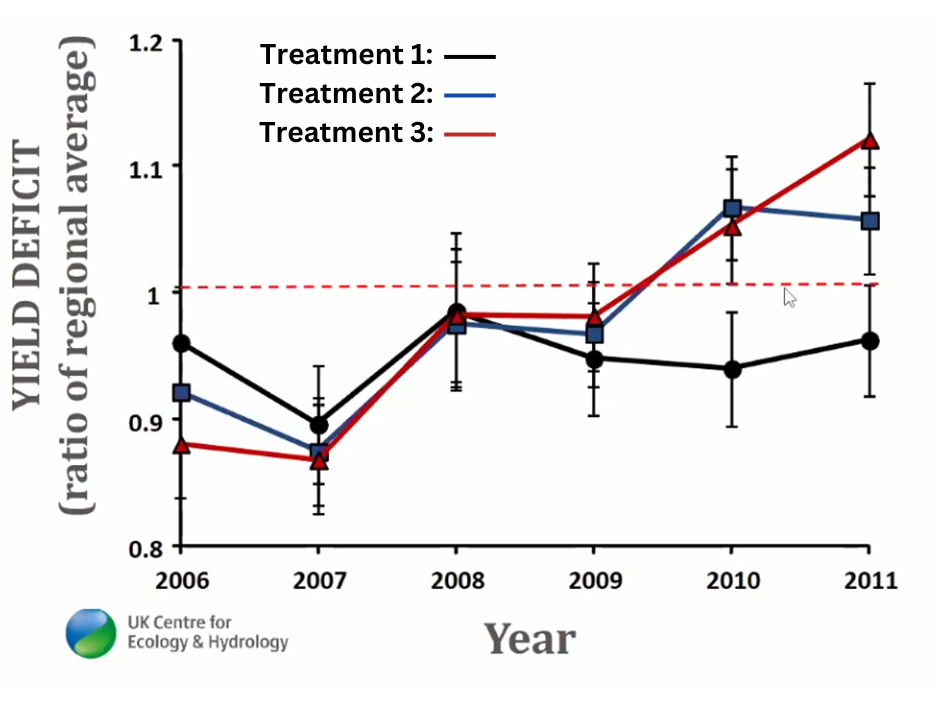

The analysts created a model to evaluate the potential market for insect protein, assuming there are no supply or legal restrictions.

No more crawling: Insect protein will grow up in the 2020s February 2021 © RaboResearch

They looked at three phases up to 2030: a scale-up phase, a broader useful life and the maturity phase.

“We believe that the price of insect protein will not go down much in the scale-up phase. We therefore expect prices between 3,500 and 5,500 euros per ton. However, we anticipate that once the first phase of scale-up is complete, prices will drop by € 1,000 per ton and a further € 1,000 per ton when the sector is mature. “

The second growth phase for insect proteins and other insect-derived products will be based on the functional properties of insects.

“There is increasing research to show that the inclusion of insect proteins has some positive characteristics that go beyond nutritional value. One of them is palatability. Additionally, research suggests that intestinal health for certain species can be improved by including insects in the diet. High-quality freshwater species such as eels and sturgeon, which are primarily insect and crustacean eaters in the wild, particularly benefit from having insect protein in their diet. It is likely that feeds for these species and other freshwater catfish, trout and smolt (the juvenile freshwater stage of salmon) are where insect proteins have the greatest initial benefit when ingested. ” If you

Finally, and probably less well documented in current research, is the antioxidant function of insect proteins, they said.

At this stage of broader application, insect proteins are used alongside fish meal and soybean meal, but at relatively low inclusion rates sufficient to achieve their functional properties. Therefore, their price does not reflect what they are replacing, but what they add to the feed’s overall value proposition. “This should enable a profitable scale-up.”

However, it is clear that not only is more research needed, but the functional properties of the aquafeed industry need to be demonstrated in a commercial setting. While there is some very promising evidence, it will take time, the authors said.

“We assume that the cost level will be more comparable to fishmeal after 2030.”